SWOT analysis

We continue with part 2 of the topic ‘Creating medico-marketing strategy’ and as mentioned in Part 1, this time we focus on SWOT analysis.

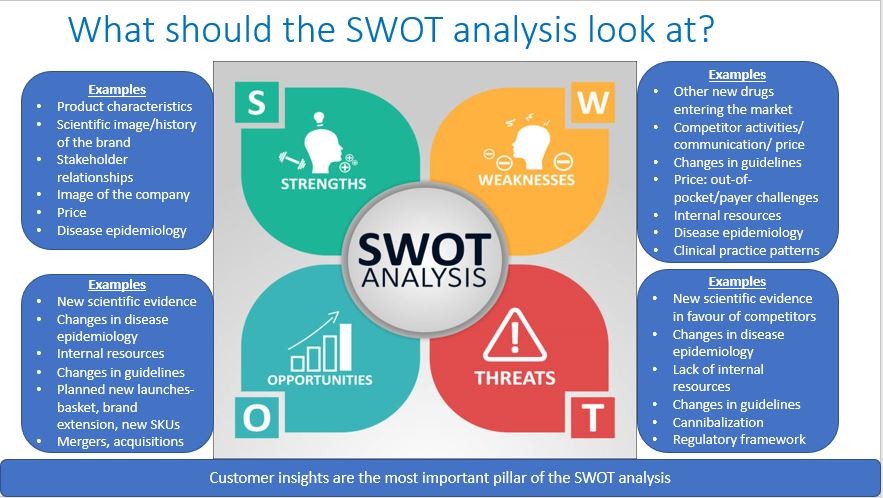

I have listed some common points considered under SWOT analysis in the image above; however, it is a vast and endless topic and there is no standard list of items to include or exclude. Moreover, the items are interchangeable because any item could be a strength for one product, a weakness for another, an opportunity for a third one, and a threat for a fourth one.

Nevertheless, we will discuss some that are usually always a part of SWOT analysis in the healthcare industry.

- Product characteristics: Undoubtedly this has to be top of the list but not always. for e.g., in medical devices there are clear distinguishing features and no two products can be completely alike. If you have a unique feature that competitors don’t and you have scientific evidence to back the benefits of that feature, this would form the epicenter of your strategy. This also allows you to command a higher price. Whereas if your closest competitor(s) has an advantageous feature that your product does not, you would have to convert something else into strength e.g., maybe there is scientific evidence that the absence of the unique feature does not lead to poorer outcomes. Or maybe your brand is a legacy brand, or you have better relationships, maybe you are known to be strongly focused on science etc. Perhaps the users of your product see an advantage that you haven’t even thought of. Hence, customer insights are the most important. Focusing on product characteristics in the case of generic products is difficult in pharma unless the formulation has some advantages like easy dosage form etc. However, such advantages do not last long as they are quickly copied, unlike in devices.

- Clinical practice patterns: I think that having a pulse on these can be a make or break in a crowded market with tens of generics and me-toos. A strategy created by understanding these patterns always stays relevant. Insights into clinical practice patterns can only be obtained through regular interactions with HCPs by sales, marketing as well as medical affairs. It helps you understand what is used/prescribed when, why, when not, why not, what is used/prescribed with what, what are the challenges with treatment, what help are the HCPs looking for. Besides, if we can partner with them to help them achieve better patient outcomes e.g., through nurses’ training, patient counseling or in any other way, it builds relationships and helps us look at practical challenges and what we could do to help overcome these challenges. These one-to-one interactions can prove more important than advisory boards. I remember some years ago these interactions helped us create customized scientific communication for the leading KOLs and turned around a degrowing brand. We focused just on 90 HCPs all over India and tried to understand their practice patterns for a disease and the reasons for the same. We could see clear patterns of strategies followed by each of them. Put together there were in all no more than 10-15 strategies being followed and each had a scientific basis. Some were as simple as ‘I follow this strategy because guidelines say so.’ But there were some areas not addressed by the guidelines. Based on the clinical insights we created 10-15 customized evidence-based scientific communication points making sure we were not countering the guidelines- only 1 to be focused on for a single HCP. These were discussed with them in-clinic by medical affairs rather than just sent out as newsletters/LBLs etc. There could be other examples like numerous drugs being available for a condition like hypertension and no clarity on which is best for which patient profile. There is plenty of evidence out there, which might be difficult for a clinician to find time to search. We could possibly curate this for them. If you notice my graphic above, it says, ‘Customer insights is the most important pillar of SWOT analysis.’ The key to the success of a medico-marketing plan is clear and scientific communication and does not always necessarily have to be ‘my product only.’

- Price- Personally, I don’t think playing on price is a good strategy. A good product automatically commands a premium. At the same time, a very high price can be a weakness. In pharma it can be an opportunity for a company planning to expand its portfolio by introducing a product that is likely to lose a patent soon; however, this becomes a threat to the company owning the patent. But focusing merely on price never wins the game because there is always somebody else who can offer a lower price.

- Changes in guidelines- This can indeed have a huge impact. If the guidelines are in line with what you have been focusing on, it is an easy win-win. However, if they recommend your type of product not to be used it is a herculean task. This is a true test of the medico-marketing team. You might need to bring up and communicate evidence that shows outcomes different from those in the guidelines or even generate evidence through RWE studies.

- Disease epidemiology- It is important to keep track of this to plan new products, decide on which to focus more on from your current portfolio, line extensions, and possibly also decide to exit some therapy areas/products. In fact, it can be a very useful tool to bring into focus, diseases that are not focused on by the medical community – in a way you can become the market leader purely by focusing on the disease and medical communication associated with it. Nevertheless, it might not be a good idea to launch a 101st generic when there are already 100 in the market just because the prevalence of a disease is increasing and likely to increase further. We all saw the mad rush by everyone to manufacture remdesevir for COVID. It was purely a herd mentality in the absence of scientific evidence. Again, possibly because nobody cared to understand ‘customer insights.’

The topic of SWOT analysis can go on and on; this is a topic that is never likely to be irrelevant.